UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ | | | Preliminary Proxy Statement |

☐ | | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | | | Definitive Proxy Statement |

☐ | | | Definitive Additional Materials |

☐ | | | Soliciting Material under §240.14a-12 |

Sterling Bancorp, Inc. |

(Name of Registrant as Specified In Its Charter) |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

☒ | | | No fee required. | |||

☐ | | | Fee paid previously with preliminary materials | |||

☐ | | | Fee computed on table | |||

To Our Shareholders:

You are cordially invited to attend the 2023 annual meeting of shareholders (the “Annual Meeting”) of Sterling Bancorp, Inc. (“Sterling”), which will be held virtually on Wednesday, May 17, 2023, at 1:00 p.m., Eastern Time. There is no physical location for the Annual Meeting.

The attached Notice of Annual Meeting and the attached Proxy Statement describe the business to be transacted at the Annual Meeting. Directors and officers of Sterling, as well as a representative of Crowe LLP, the accounting firm appointed by the Audit Committee of the Board of Directors to be Sterling’s independent registered public accounting firm for the fiscal year ending December 31, 2023, will be present at the Annual Meeting to respond to appropriate questions.

Please complete, sign, date and return the accompanying proxy card promptly or, if you prefer, vote by using the telephone or Internet, whether or not you plan to attend the Annual Meeting. Your vote is important regardless of the number of shares you own. Voting by proxy will not prevent you from voting in person at the Annual Meeting, but it will assure that your vote is counted if you are unable to attend the meeting. To attend the Annual Meeting virtually, you will need to have your 16-digit control number that is included on your proxy card.

On behalf of the Board of Directors and the employees of Sterling, we thank you for your continued support and hope that you can attend the Annual Meeting.

Sincerely,

Thomas M. O’Brien

Chairman, President and Chief Executive Officer

One Towne Square, Suite 1900

Southfield, Michigan 48076

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held May 15, 201817, 2023

NOTICE IS HEREBY GIVEN that the 20182023 annual meeting of shareholders (the “Annual Meeting”) of Sterling Bancorp, Inc., a Michigan corporation (the “Company”), will be held virtually on Tuesday,Wednesday, May 15, 2018,17, 2023, at One Towne Square, Suite 1900, Southfield, Michigan 48076,www.virtualshareholdermeeting.com/SBT2023, at 1:00 p.m., Eastern Time. There is no physical location for the Annual Meeting. To attend the Annual Meeting virtually, you will need to have your 16-digit control number that is included on your proxy card. You will not be able to physically attend the meeting in person. The agenda for the 2018 Annual Meeting of Shareholders is as follows:

| 1. |

| 2. |

| 3. |

| To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof, all in accordance with the accompanying proxy statement. |

The Board of Directors of the Company (the “Board”Board of Directors”) recommends a vote FOR each of the Directordirector nominees named in thisthe accompanying proxy statement,FOR the advisory, non-binding approval of the compensation of our named executive officers for 2022, and FOR the ratification of the appointment of Crowe Horwath LLP’s appointment.

LLP.

The Board of Directors has fixed March 23, 2018,2023, as the record date for the determination of shareholders entitled to notice of and to vote at the Annual Meeting or any adjournment or postponement of the Annual Meeting.

We are pleased to utilize the virtual shareholder meeting technology to provide ready access and cost savings for our shareholders and the Company. The virtual meeting format allows attendance from any location in the world.

We call your attention to the proxy statement accompanying this notice for a more complete statement regarding the matters to be acted upon at the Annual Meeting. Please read it carefully.

If you have questions or comments, please direct them to Sterling Bancorp, Inc., One Towne Square, Suite 1900, Southfield, MI 48076, Attention: Thomas Lopp.

Chief Legal Officer and Corporate Secretary.

| | | By order of the Board of Directors | ||

| |  | |||

| | Elizabeth M. Keogh | |||

| | Chief | Corporate Secretary |

Your vote is important. Even if you plan to attend the Annual Meeting, youYou may vote your shares electronically via the Internet, by using the telephone or, if you prefer the paper copy, please date and sign the enclosedaccompanying proxy form,card, indicate your choice with respect to the matters to be voted upon and return it promptly in the enclosedaccompanying envelope. Note that if your stock is held in more than one name, all partiesowners must sign the proxy form.

card.

Dated: April 13, 20186, 2023

GENERAL INFORMATION

This proxy statement and the enclosedaccompanying proxy card are furnished in connection with the solicitation of proxies by the Board of Directors (the“Board of Directors” or “Board”) of Sterling Bancorp, Inc., a Michigan corporation (the “Company”), to be voted at the 20182023 annual meeting of shareholders of the Company (the “Annual Meeting”) to be held virtually on Tuesday,Wednesday, May 15, 2018,17, 2023, at One Towne Square, Suite 1900, Southfield, Michigan 48076www.virtualshareholdermeeting.com/SBT2023, at 1:00 p.m., Eastern Time, for the purposes set forth in the accompanying notice and in this proxy statement.

If athe accompanying proxy in the enclosed formcard is properly executed and returned to the Company, the shares represented by the proxy card will be voted on each matter that properly arises at the Annual Meeting and any adjournment or postponement of the Annual Meeting. If a shareholder specifies a choice asEvery properly executed proxy card that is received by the Company prior to a particular matter, the proxyclosing of the polls at the Annual Meeting will be voted as specified.

A proxy may be revoked before exerciseit is voted at the Annual Meeting by notifying the Chief OperatingLegal Officer and Corporate Secretary of the Company in writing or in open meeting,at the Annual Meeting prior to the closing of the polls, by submitting a duly executed proxy of(including a proxy given over the Internet or by telephone) bearing a later date or by attending the Annual Meeting and voting in person.electronically. All shareholders are encouraged to date and sign the enclosedaccompanying proxy card, indicate a choice with respect to the matters to be voted upon and return it to the Company.

Registered Holders

If you are a “registered holder” (meaning your shares are registered in your name with our transfer agent, Computershare), then you may vote either in personelectronically at the virtual Annual Meeting using your 16-digit control number (included on your proxy card) or by proxy. If you decide to vote by proxy, you may vote via the Internet, by using the telephone or by mail and your shares will be voted at the Annual Meeting in the manner you direct. For those shareholders who wish to vote by mail, such shareholders can complete, sign and return the mailedaccompanying proxy card in the prepaid and addressed envelope that was enclosed withaccompanied the proxy materials. Internet and telephone voting facilities for shareholders of record will close at 1:00 a.m.11:59 p.m., Eastern Time, on Tuesday, May 15, 2018. Instructions16, 2023. Further instructions for voting via the Internet and telephone are set forth on the accompanying proxy card. Registered holders will be entitled to one (1) vote for each share held of record as of the record date for all matters.

1

Beneficial Holders

If you are a beneficial owner of shares held in “street name,” you may vote in personelectronically at the Annual Meeting only if you obtain a legalusing the 16-digit control number included on your proxy from the nominee that holds your shares and present it to the inspector of elections with your ballot at the Annual Meeting.card. Alternatively, you may provide instructions to the nominee that holds your shares to vote by completing, signing and returning the voting instruction form that the nominee provides to you, by using telephone or Internet voting arrangements described on the voting instruction form or other materials that the nominee provides to you or by following any other procedures that the nominee communicates to you.

Quorum, Required Vote, and Related Matters

Quorum. A quorum is present if the number of shares entitled to cast a majority of the votes on a proposal is represented at the Annual Meeting by proxy or in person (by electronic participation). Abstentions and broker non-votes will be counted as present only for the purpose of determining whether a quorum is present.

“Street Name” Accounts. If you hold shares in “street name” with a broker, bank or other custodian, you will receive voting instructions from the holder of record of your shares. In some cases, a broker may be able to vote your shares even if you provide no instructions. However, certain regulations prohibit your broker, bank or other nominee from voting uninstructed shares on a discretionary basis for Proposal Nos. 1 and 2 at the Annual Meeting. Shares for which a broker does not have the authority to vote are recorded as “broker non-votes” and are not counted in the vote by shareholders. Thus, if you hold your shares in street name and you do not instruct your broker on how to vote at the Annual Meeting, votes may not be cast on your behalf for Proposal Nos. 1 and 2.

Proposal No. 1 – Election of Directors. Directors are elected by a plurality of the votes cast by the shares entitled to vote. For this purpose, a “plurality” means that the individuals receiving the largest number of votes are elected as directors. You may vote in favor of the nominees specified on the accompanying proxy card or may withhold your vote as to one or more of such nominees. Shares withheld or not otherwise voted in the election of directors (because of abstention, broker non-vote or otherwise) will have no effect on the election of directors.

Proposal No. 2 – Advisory, Non-Binding Vote to Approve the Compensation of our Named Executive Officers for 2022. The affirmative vote of a majority of the votes cast by the holders of shares entitled to vote will be considered our shareholders’ approval of the advisory, non-binding resolution approving the compensation of our named executive officers for 2022. Shares withheld or not otherwise voted with respect to this proposal (because of abstention, broker non-vote or otherwise) will not be counted as votes cast and will have no effect on the vote on this proposal.

Proposal No. 3 – Ratification of the Appointment of the Company’s Independent Registered Public Accounting Firm. The affirmative vote of a majority of the votes cast by the holders of shares entitled to vote is required for ratification of the appointment of Crowe LLP as our independent registered public accounting firm for 2023. Shares withheld or otherwise not voted with respect to this proposal (because of abstention, broker non-vote or otherwise) will not be counted as votes cast and will have no effect on the vote on this proposal.

Although the vote on Proposal No. 2 is not binding on the Company, the Executive Compensation Committee of the Board of Directors (the “Compensation Committee”) will take your vote on this proposal into consideration when determining the compensation of our named executive officers. Although the vote on Proposal No. 3 is not binding on the Company, the Audit Committee of the Board of Directors will take your vote on this proposal into consideration when selecting our independent registered public accounting firm in the future.

2

The Second Amended and Restated Articles of Incorporation (“Articles of Incorporation”) and Amended and Restated Bylaws (“Bylaws”) of the Company provide for a Board consisting of a number of members to be determined by a resolution adopted by the affirmative vote of at least 80% of the Board and a majority of the “Continuing Directors” (as defined in the Articles of Incorporation). The Board has fixed the number offollowing nine (9) directors at nine. The Articles of Incorporation and Bylaws of the Company also provide for the division of the Board into three classes of nearly equal size with staggered three-year terms of office. See “Information about Directors and Nominees–Director Information” below. Three persons have been nominated for election to the Board of Directors at the Annual Meeting, each to servehold office for a three-year term expiring at the 2021next annual meeting of shareholders.

shareholders and until his or her successor is duly elected and qualified or his or her earlier resignation or removal:

Thomas M. O’Brien | | Peggy Daitch | | Tracey Dedrick | ||

| | | |||||

Michael Donahue | | | Steven E. Gallotta | | | Denny Kim |

| | | |||||

Eboh Okorie | | | Benjamin Wineman | | ||

| | Lyle Wolberg |

Unless otherwise directed, the persons named as proxy holdersproxies in the accompanying proxy card will vote for Messrs. Allen, Fox, and Wolberg, the election of the foregoing nominees. All nominees named below. Messrs. Allen, Fox, and Wolberg are currently directors of the Company, and are the members of the class of directors of the Company whose terms will expire at the Annual Meeting.Company. In the event that any of the nominees becomebecomes unavailable, which is not anticipated, the Board of Directors, in its discretion, may reduce the number of directors or designate substitute nominees, in which event the enclosed proxyall properly executed proxies will be voted for such substitute nominees. Proxies cannot be voted for a greater number of directors than the number of nominees named.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE ELECTION OF THE DIRECTOR |

Information about Directors and Nominees

The Company believes that the Board of Directors as a whole should encompass a range of talent, skill, diversity and expertise that enables the Board of Directors to provide sound guidance with respect to the Company’s operations and interests. The following information has been furnished to the Company by the respective directors. Each of them has been engaged in the occupations stated below during the periods indicated, or if no period is indicated, for more than five (5) years.

Nominees Standing for Election

Thomas M. O’Brien, Chairman, President and Chief Executive Officer. Mr. O’Brien has served as Chairman, President and Chief Executive Officer of the Company and Sterling Bank and Trust, F.S.B. (the “Bank”) since June 2020. Prior to his appointment, Mr. O’Brien provided consulting services to the Bank beginning in March 2020. Mr. O’Brien is an accomplished leader in the financial services industry with over 45 years of industry experience. Prior to joining Sterling, he served as Vice Chairman of New York City-based Emigrant Bancorp, Inc. and Emigrant Bank from October 2018 to March 2020. Mr. O’Brien served as president, chief executive officer and on the boards of Sun Bancorp, Inc. and Sun National Bank from April 2014 to February 2018. Mr. O’Brien previously served on the boards of BankUnited, Inc. and BankUnited, NA from May 2012 to April 2014. Prior to that, Mr. O’Brien served as president, chief executive officer and a director of State Bank of Long Island and State Bancorp, Inc. from November 2006 to January 2012. From 2000 to 2006, Mr. O’Brien was president and chief executive officer of Atlantic Bank of New York and, following the acquisition of Atlantic Bank of New York by New York Commercial Bank, continued to serve as president and chief executive officer during the post-closing transition. From 1996 to 2000, Mr. O’Brien was vice chairman and a board member of North Fork Bank and North Fork Bancorporation, Inc. Mr. O’Brien began his career at North Side Savings Bank in 1977, where he worked until 1996, becoming chairman, president and chief executive officer in 1985. Mr. O’Brien served as a director of the Federal Home Loan Bank (the “FHLB”) of New York from 2008 to 2012 and served as chairman of the New York Bankers Association in 2007. Mr. O’Brien is currently trustee and chairman of the board of Prudential Insurance Company of America $200 Billion Annuity Fund Complex, and vice-chairman of the board and chairman of the finance committee of ArchCare and Catholic Healthcare Foundation for the Archdiocese of New York. Mr. O’Brien received a B.A. in Political Science from Niagara University in 1972 and an M.B.A. from Iona University in 1982.

Peggy Daitch, Director. Ms. Daitch has served as a member of our Board of Directors since 1998. HeDecember 2019. Ms. Daitch brings over 40 years of experience as a highly respected and recognized advertising and marketing

3

executive, innovative thinker and community leader. After leaving General Motors’ largest advertising agency (D’Arcy Masius Benton & Bowles) as a Vice President, she spent the majority of her career with Condé Nast (1987–2008), where she was a Vice President and the leader of Detroit’s Condé Nast office representing, at its peak, 29 of America’s most celebrated magazine titles and websites including Vogue, Vanity Fair, The New Yorker, Golf Digest, Architectural Digest, Wired, Bon Appetit, epicurious.com and wired.com. She has also represented titles from Hearst Corporation, National Geographic and other leading media companies. After retiring from advertising in 2016, Ms. Daitch pivoted to a new role at Strategic Philanthropy, Ltd., stewarding the 20-year philanthropic advisory firm’s growth in Michigan where she was a consultant. Immediately prior to this position, Ms. Daitch served as a Partner of Aperture Media Group from 2010 to 2016. Ms. Daitch was the first woman to be president of the Adcraft Club of Detroit, the world’s largest advertising club. She has been a memberhonored with The Advertising Woman of the boardYear Award and has been inducted into the Adcraft Hall of directors, and chairman of the audit committee since 1998. Mr. Allen was the Regional Managing Partner, Owner, Member of the Management Committee, and Director of Baker Tilly Virchow Krause, LLP. Mr. Allen began his career at PriceWaterhouseCoopers, LLP as a junior accountant. In 1972 he founded Barry Allen & Associates, P.C. and developed it into a prestigious boutique CPA and Tax Firm, providing services to small and medium sized companies. In 1982, he partnered with another firm and formed Nemes Allen & Company, PLLC, where he was Managing Partner until 2003. Mr. Allen served middle market companies and high net worth individuals. Mr. Allen has previously served on the Board of Directors and acted as Treasurer of Forgotten Harvest, a food rescue organization. Additionally, he served on the Board of Directors of Pathway Family Centers, an adolescent addiction and recovery center. He has a BBA from the University of Detroit, and is a certified public accountant. He also was a Certified Insolvency and Reorganization Accountant, and had a State of Michigan Insurance License in the past. He currentlyFame. She serves on the Board of Governors of Cranbrook Academy of Art and Museum where she is a member of the Riviera Dunes Marina CondominiumExecutive Committee. She is a past president of Hebrew Free Loan of Metropolitan Detroit and has held board positions with the Jewish Federation of Metropolitan Detroit, Franklin Hills Country Club, the Detroit Institute of Arts Founders Junior Council, the Michigan Arts Foundation, CATCH, Jewish Ensemble Theater and others. Ms. Daitch is a graduate of the University of Michigan.

Our Board of Directors believes that Ms. Daitch should serve as a director because of her experience as an executive and her highly respected reputation as an innovative thinker and leader.

Tracey Dedrick, Director. Ms. Dedrick has served as a member of our Board of Directors since 2020. Ms. Dedrick brings over 40 years of experience in the financial services industry to the Board. She is a former Executive Vice President and Head of Enterprise Risk Management for Santander Holdings U.S., where she was responsible for enterprise risk, operational risk and market risk for the Americas from September 2016 until her retirement in 2017. Prior to that role, Ms. Dedrick was Executive Vice President and Chief Risk Officer at Hudson City Bancorp from July 2011 until November 2015 and served with its successor, M&T Bank, from November 2015 to February 2016. From January 2010 to February 2011, Ms. Dedrick served as the Treasurer of PineBridge Investments, an asset management company with $83 billion in assets under management. Prior to this, Ms. Dedrick was employed by MetLife, the largest insurance provider in the United States, where she served as Vice President and Assistant Treasurer from June 2001 until July 2004, Vice President and Head of Investor Relations from July 2004 until July 2007 and then served as the Senior Vice President and Head of Market Risk from July 2007 until September 2009. Ms. Dedrick currently serves on the board of directors of First BanCorp., where she is also the Chair of First Bancorp.’s Risk Committee. Additionally, Ms. Dedrick currently serves as the Chair and a board member of the Information Systems Audit and Control Association (“ISACA”). As a board member of ISACA, Ms. Dedrick is a member of ISACA’s Risk and Technology Committee and Compensation Committee as Treasurer,well as the Chair of its Executive Committee. Ms. Dedrick previously served as a board member of Fieldpoint Private, a private wealth management firm. Ms. Dedrick obtained her Bachelor of Arts in Economics from the University of Minnesota—Twin Cities.

Our Board of Directors believes that Ms. Dedrick should serve as a director because of her relevant experience in the financial services industry, particularly in enterprise risk management and ontreasury functions.

Michael Donahue, Director. Mr. Donahue has served as a member of our Board of Directors since 2022. Mr. Donahue brings to the Board of Legend Valve, Inc.,Directors a non‑publicly traded company.wealth of legal and banking experience in the financial services industry. Mr. Donahue is a former Global Head of Securitization for BNP Paribas, arranging short- and long-term financing, both on and off balance sheet, for corporate and bank clients through the commercial paper and debt capital markets with teams based in New York, London, Paris, Milan, and Tokyo. Prior to joining BNP Paribas, Mr. Donahue was a Senior Managing Director for Merrill Lynch in London where he co-head the group charged with executing all transactions involving structured debt and collateralized loan/bond/debt obligations. Before that, Mr. Donahue was a Director and Deputy Head of Deutsche Bank AG’s European Securitization Group, a practice he co-founded and helped grow into the leading securitization group in Europe with an emphasis on regulatory capital relief. Before joining Deutsche Bank, Mr. Donahue was an associate in Lehman Brothers’ Mortgage Finance Group. Mr. Donahue began his Wall Street career as an associate attorney in the capital markets practice at the law firm of Cadwalader, Wickersham and Taft. Since leaving BNP Paribas in 2005, Mr. Donahue has focused on his personal investments including most recently the growing of a portfolio of renovated single-family homes for rent subsidized tenants in Chicago. Mr. Donahue has a B.S. in business management from the University of Maryland and a J.D. from Cornell Law School and is admitted to the New York Bar.

Our Board of Directors believes that Mr. Donahue should serve as a director because of his extensive experience in the financial and banking industries.

Steven E. Gallotta, Director. Mr. Gallotta has served as a member of our Board of Directors since 2020. Mr. Gallotta brings over 35 years of financial reporting and assurance experience in the financial services industry to the Board of Directors. Mr. Gallotta spent the majority of his career at KPMG, from 1975 until his mandatory retirement from the firm in 2013. He became an audit partner in the New York Financial Services Practice of KPMG in 1986, serving all types of financial institutions, including depository institutions. During this time, Mr. Gallotta also served as an Advisory partner in KPMG’s Office of General Counsel. Since 2016, Mr. Gallotta has served on the board of directors of St. Patrick’s Home for the Aged and Infirm, a non-compensated role, in the Bronx, New York. Mr. Gallotta has been a certified public accountant licensed in New York since 1979. He obtained his Bachelor of Business Administration from Iona University.

Our Board of Directors believes that Mr. AllenGallotta should serve as a director because of his extensive experience in the business and financial world, as well as his particular expertise in U.S. Securities and Exchange Commission (the “SEC”) matters and accounting and management issues.

Denny Kim, Director.Jon Fox, Director. Mr. FoxKim has served as a member of our Board of Directors since 1997.2020. Mr. Fox has forty‑twoKim brings over 15 years of financial experience including twenty yearsto the Board of executive level commercial banking management experience.Directors. Mr. Fox wasKim is the Chief Executive Officer and member of the board of directors of Whale Point Acquisition Corp. and Founder of Whale Point Capital LLC, a private investment firm focused exclusively on the financial services & FinTech industries since 2022. Mr. Kim is also the HeadManaging Principal of Commercial Lending7911 Partners, a private investment and advisory firm he founded in Detroit, Michigan at City National Bank, and2019. Previously, Mr. Kim was a prior Head of Commercial Real Estate Lendingsenior investment professional and Investment Committee Member at Comerica.WL Ross & Co., a private equity firm founded by former U.S. Commerce Secretary Wilbur L. Ross, where he specialized in financial services investments from 2010-2018. Prior to WL Ross & Co., Mr. Fox was an advisorKim worked at J.C. Flowers & Co., a private equity firm dedicated to investing globally in the financial services industry. Mr. Kim began his career at Credit Suisse First Boston’s Investment Banking Division, where he advised on mergers, acquisitions and capital raising initiatives for PEM,financial institutions. Mr. Kim previously served as a real estate holding company, a foundermember of the Americans for International Aid and Adoption, and a Director for the Community Housing Network since 1976. Past board experience includes the Macomb Savings Bank, Mortgage Bankers Association, Kiwanis #1 (Detroit) and Clawson Manor. He was alsoof directors of Talmer Bancorp, Inc., a board memberobserver at Sun Bancorp, Inc. and Advisor at Gemspring Capital. Mr. Kim earned a Bachelor of Ryan Homes, the President of Fox Manor,Arts degree from Northwestern University and an Advisor and Finance Committee memberMBA from Tuck School of Vista Maria. He has a BS in Finance from Wayne State University.

Business at Dartmouth.

Our Board of Directors believes that Mr. Fox should serve as a director because of his significant financial and executive level commercial banking experience.

Eboh Okorie, Director.Gary Judd, Chairman and Chief Executive Officer. Mr. Judd has served as our chairman and chief executive officer since August 2008. Additionally, he served as our president from 2008 until 2016. He began his banking career with Citibank, serving over sixteen years, including assignments over eight years in international banking based in New York, the Middle East, and India. Mr. Judd held positions in commercial lending, operations, treasury/foreign exchange, and country management. He held domestic positions in Citibank’s Operating Group, worked on acquisitions at Citicorp, and ending as Citibank’s Consumer Group’s senior executive for Manhattan south of Forty Second Street. Mr. Judd was also responsible as a business manager for a large‑scale consumer banking system development project. He then served as a general partner of Campbell Oil, Ltd., a private oil and gas exploration and production company in Denver, Colorado.

Kansas.

Our Board of Directors believes that Mr. MeltzerOkorie should serve as a director because of his investment expertise and deep historical knowledge of the Company. He helped guide the Bank through the 2008 financial crisis and was instrumentalextensive experience in curing Sterling’s troubled asset and OREO portfolio. He currently chairs the Bank’s ALCO Committee.bank regulatory compliance.

Benjamin J. Wineman, Director. Mr. Wineman has served as a directormember of our Board of Directors since 2013. Mr. Wineman has 2024 years of extensive commercial real estate and financial experience. Currently, Mr. Wineman is a Principal and Managing Broker at Mid‑AmericaMid-America Real Estate Corporation, where he has worked since July 2001. Mid‑AmericaMid-America is a privately held retail real estate services firm based in Chicago Illinois, and is one of the companies within Mid‑America Real Estate Group, a midwestern full‑service retail real estate organization with offices in Chicago, Detroit, Milwaukee, and Minneapolis. Mr. Wineman co‑leads Mid‑America’sco-leads Mid-America’s Retail Investment Sales Group, focusing specifically on the disposition of shopping centers and retail properties throughout the greater Midwest region for institutional, REIT, and private owners. Prior to employment with Mid‑America,Mid-America, Mr. Wineman worked at LaSalle Investment Management (JLL) as a Financial Analyst in the Private Equity Acquisitions Group, where he was responsible for the

5

valuation, due diligence, and closing of commercial real estate transactions on behalf of its institutional pension fund clients from 1998 to 2001. Within the International Council of Shopping Centers, (ICSC), he is a member of the Illinois State Committee and the Government Relations National Economic Policy Sub‑Committee.Sub-Committee. Within the community, Mr. Wineman is a member of the Executive CommitteesCommittee of the Harold E. Eisenberg Foundation and the board Presidentis a sustaining member of the Ravinia Festival Associates Board and a member of the executive committee of the Ravinia Festival Board of Trustees.(having served as board President from 2017-2019). Mr. Wineman graduated from DePauw University in 1998 with a Bachelor’sBachelor of Arts Degree.

Our Board of Directors believes that Mr. Wineman should serve as a director because of his extensive commercial real estate and financial experience.

Lyle Wolberg, Director.Sandra Seligman, Director. Ms. Seligman Mr. Wolberg has served as a member of our Board of Directors since its inception2017. He is one of the founding partners of Telemus Capital Partners, a financial advisory firm he co-founded in 1984. Ms. Seligman2005. Mr. Wolberg was a former Financial Advisor at Merrill Lynch from 1994 to 1997 and Senior Vice President-Investments at UBS Financial Services from 1999 to 2005. Mr. Wolberg has more than 20 years of industry experience across all facets of financial wealth planning and investment management. He is a philanthropist, actively dedicating her professional timecertified financial planner. He serves on the boards of The Children’s Foundation and expertise to the charitable communitiesFirst Tee of Greater Detroit, Miami, and New York City. Throughis Past President and Co-Founder of the Seligman Family Foundation, Ms. Seligman contributes to the Mount Sinai Medical CenterBerkley Educational Foundation. Mr. Wolberg has a B.B.A. in Florida,finance from the University of San Francisco Medical Center in California, the Beaumont Health System, and Wayne State University Medical School in Michigan. Ms. Seligman is also a director of the Wolfsonian‑Florida International University, the Museum of Contemporary Art of Detroit, the Detroit Institute of Arts, and the Jewish Women’s Foundation of the Jewish Federation of Detroit. She has a BS from Michigan State University.

Our Board believes that Ms. Seligman should serve as a director because of her long term commitment to and experience with the Company. Additionally, Ms. Seligman’s significant involvement with community and charitable groups brings unique insights to the Board.

Board Diversity

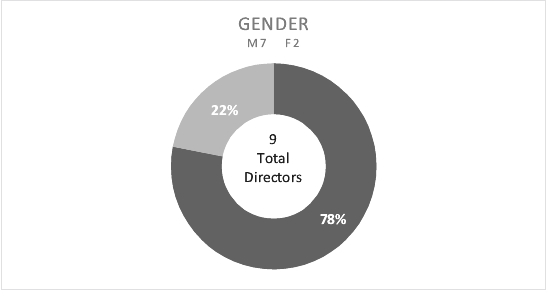

| | Board Diversity Matrix (as of April 6, 2023) | | ||||||||||||

| | Total Number of Directors | | | 9 | | |||||||||

| | | | Female | | | Male | | | Non-Binary | | | Did Not Disclose Gender | | |

| | Part I: Gender Identity | | ||||||||||||

| | Directors | | | 2 | | | 7 | | | — | | | — | |

| | Part II: Demographic Background | | ||||||||||||

| | African American or Black | | | — | | | 1 | | | — | | | — | |

| | Alaskan Native or Native American | | | — | | | — | | | — | | | — | |

| | Asian | | | — | | | 1 | | | — | | | — | |

| | Hispanic or Latinx | | | — | | | — | | | — | | | — | |

| | Native Hawaiian or Pacific Islander | | | — | | | 1 | | | — | | | — | |

| | White | | | 2 | | | 5 | | | — | | | — | |

| | Two or More Races or Ethnicities | | | — | | | 1 | | | — | | | — | |

| | LGBTQ+ | | | — | | | — | | | — | | | — | |

| | Did Not Disclose Demographic Background | | | — | | |||||||||

6

In addition to gender and demographic diversity, we also recognize the Presidentvalue of Gardner-White Furniture, a Michigan furniture retailer founded in 1912. Priorother diverse attributes that directors may bring to joining Gardner-White Furniture in 2012, Ms. Tronstein Stewart worked in clean energy technologies, most recently atour Board, including veterans of the U.S. Department of Energy. She helped to develop the department’s SunShot Initiative, a project to make solar energy cost-competitive with traditional sources of electricity by 2020. Previously, Ms. Tronstein Stewart focused on the clean energy portfolio at former President Clinton’s Clinton Global Initiative. Ms. Tronstein Stewart earned an MSc from the London School of Economics and a BA from the University of Michigan. She was also recently appointed the Board Chair of New Detroit, a coalition of leaders working towards racial equity in Metropolitan Detroit.

Military. We are a “controlled company” under the rules of Nasdaq because more than 50%proud to report that one of our outstanding voting powerdirectors is helda military veteran.

| | |  |

| | |  |

Legal Proceedings

Previously, the Bank was under formal investigation by the Seligman family trustee. See “Beneficial Ownership of Common Stock.” We do not intend to rely upon the “controlled company” exception relating to the board of directors and committee independence requirements under the rules of Nasdaq. The “controlled company” exception does not modify the independence requirements for the audit committee, and we comply with the audit committee requirementsOffice of the Exchange Act and the rules of Nasdaq. Absent the useComptroller of the “controlled company” exception, the rulesCurrency (the “OCC”) relating primarily to certain aspects of the NASDAQ Capital Market, independent directors must comprise a majority of our board of directors within a specified period of time of this offering. The rules of the NASDAQ Capital Market,its Bank Secrecy Act/Anti-Money Laundering (“BSA/AML”) compliance program as well as thosethe Bank’s credit administration, including its Advantage Loan Program. The Bank was also subject to a publicly available formal agreement with the OCC (the “OCC Agreement”), relating primarily to certain aspects of the SEC, also impose several other requirementsBank’s BSA/AML compliance program and credit administration. The OCC Agreement was entered into in June of 2019, and Mr. Wineman and Mr. Wolberg, acting as directors at that time, signed the OCC Agreement in such capacity. In September, 2022, the Company entered into a Consent Order with the OCC, resolving the OCC’s investigation, which represented a full and final settlement of the OCC investigation with respect to the independenceBank. Pursuant to that Consent Order, the Bank paid a civil money penalty of our directors. Our board$6.0 million. The OCC also notified the Bank that the OCC Agreement was terminated.

The Bank has received grand jury subpoenas from the Department of directorsJustice (the “DOJ”) beginning in 2020 requesting the production of documents and information in connection with an investigation focused on the Bank’s Advantage Loan Program and related issues, including residential lending practices and public disclosures about that program contained in the Company’s filings with the SEC. On March 15, 2023, the Company, entered into the Plea Agreement with the DOJ, resolving the DOJ’s investigation. Under the Plea Agreement, the Company has evaluatedagreed to plead guilty to one count of securities fraud primarily relating to disclosures with respect to the independenceAdvantage Loan Program contained in the Company’s 2017 IPO Registration Statement and its immediately following Annual Reports on Form 10-K filed in March 2018 and March 2019; pay $27.2 million in restitution for the benefit of non-insider victim shareholders; further enhance its members based uponcompliance program and internal controls with respect to securities law compliance; and provide periodic reports to the rulesDOJ with respect to compliance matters. No criminal fine was imposed. The Company’s obligations under the Plea Agreement are generally effective for three years. This resolution releases the Company, as well as the Bank, from further prosecution for securities fraud and underlying mortgage fraud in the Advantage Loan Program. The Plea Agreement remains subject to final court approval.

The Company remains under a formal investigation initiated by the SEC in the first quarter of 2021. This investigation appears to be focused on accounting, financial reporting and disclosure matters, as well as the

7

Company’s internal controls, related to the Advantage Loan Program. The Bank and the Company are fully cooperating with the SEC investigation. Although the Company and the Bank continue to remain under investigation by the SEC, the Company currently believes that the SEC investigation will not result in an enforcement action against the Company.

On October 7, 2022, the Company and the Bank commenced an action against the Bank’s founder and controlling shareholder, and other nominal defendants, in the United States District Court for the Eastern District of Michigan styled Sterling Bank and Trust, F.S.B. and Sterling Bancorp, Inc. vs. Scott Seligman, et al., No. 2:22-cv-12398-SFC-DRG (E.D. Mich.). The complaint alleges that Mr. Seligman breached his fiduciary duties to the Company and the Bank by, among other actions and inactions, using his controlling position to develop and direct the Bank’s now-discontinued Advantage Loan Program to advance his own interests and unjustly enrich himself at the expense of the NASDAQ Capital MarketCompany, the Bank and the SEC. Applying these standards, our boardCompany’s minority shareholders. The complaint seeks to recover compensatory and other damages, disgorgement of directors has affirmatively determinedcertain monies and injunctive relief. On January 30, 2023, Mr. Seligman and the nominal defendants moved to dismiss the case, and the Company and the Bank filed their opposition motions on March 13, 2023. There is no assurance that withwe will be successful in any final adjudication of this case, that any remedy would be adequate in the exception of Mr. Judd, Mr. Sinatra, Mr. Meltzer and Ms. Seligman, each of our current directors isevent we are successful in the adjudication or that we would achieve an independent director, as defined under the applicable rules.

acceptable settlement.

Board of Directors Meetings

All directors are expected to attend all meetings of the Board of Directors and of the Board of Directors committees on which they serve. All directors currently serving on the Board of Directors also serve on the board of directors of the Bank. The board of directors of the Bank met ten (10) times in 2022. The Board of Directors met twelve (12)six (6) times during 2017. In 2017, allin 2022. All incumbent directors except Sandra Seligman, attended more than 75%seventy-five percent (75%) of the aggregate number of all meetings of the Board of Directors and the committees of the Board of Directors on which he or she served. In connection with theserved during 2022. The Company’s transition post-initial public offering, the independent directors will begin holding regularly scheduledperiodically meet in executive sessions to meetsession without management present in the future.

present.

Board andof Directors Committee Membership

Current membership of the standing committees of the Board and committee membershipsof Directors are shown in the table below.

Name | | | Age | | | Position(s) With the Company | | | Nominating & Corporate Governance | | | Executive Compensation | | | Audit | | | Risk | | | Ethics & |

Mr. | | 72 | | | Chairman, President and Chief Executive Officer | | | | | | | | | | | ||||||

Ms. Daitch | 76 | | Director | | | Member | | | Member | | | | | | | Chairperson | |||||

Ms. Dedrick | 66 | | | Lead Independent Director | | | Chairperson | | | | | | | Chairperson | | | Member | ||||

Mr. | 61 | | | Director | | | | | Member | | | Member | | | | | |||||

Mr. Gallotta | 69 | | | Director | | | | | | | Chairperson | | | Member | | | |||||

Mr. | 43 | | | Director | | | Member | | | Member | | | | | Member | | | Member | |||

Mr. | 70 | | Director | | | | | | | | | Member | | | Member | ||||||

Mr. | 47 | | Director | | | | | | | Member | | | | | |||||||

Mr. Wolberg | 53 | Director | | | | | Chairperson | | | | | | |

Audit and Risk Management Committee

The Audit and Risk Management Committee (the “Audit Committee’) assists the boardBoard of directorsDirectors in fulfilling its responsibilities for general oversight of the integrity of our financial statements, compliance with legal and regulatory requirements, the independent auditors’ qualifications and independence, and the performance of our internal audit and risk management function and independent auditors. Among other things, the Audit Committee:

appoints, evaluates and determines the compensation of our independent auditors;

meets with our independent auditors and management to review the scope of each annual audit and audit procedures to be utilized;

8

reviews and discusses with the Chief Financial Officer, the Controller and other appropriate members of management and the independent auditors the Company’s consolidated annual audited financial statements and related notes;

reviews with management annual and quarterly earnings press releases and related Current Report on Form 8-K filed to report material non-public information regarding the Company’s results of operations or financial condition for each annual or quarterly fiscal period;

investigates and, if necessary, retains outside experts with respect to any complaints or concerns regarding accounting, internal accounting controls or auditing matters that are brought to the attention of the Audit Committee;

reviews and approves all transactions between the scopeCompany and related persons which are required to be reported under applicable SEC regulations and any other potential conflict of the annual audit, audit feesinterest situations on an ongoing basis, and financial statements;

individual members’ performance and effectiveness.

The Audit Committee works closely with management as well as our independent auditors. The Audit Committee has the authority to obtain advice and assistance from and receive appropriate funding to engage outside legal, accounting or other advisors as the Audit Committee deems necessary to carry out its duties.

The Audit Committee is composed solely of members who satisfy the applicable independence and other requirements of the SEC and the NASDAQNasdaq Capital Market (“Nasdaq”) for Audit Committees. Mr. Allen isaudit committees. Steven E. Gallotta serves as the Company’s “audit committee financial expert” as such term is defined in applicable SEC regulations.

The Audit Committee has adopted a written charter that, among other things, specifies the scope of its rights and responsibilities.

The Board has adopted a charter for the Audit Committee, a copy of which is available on the Company’s website at www.investors.sterlingbank.com.investors.sterlingbank.com/corporate-governance/governance-overview. The Audit Committee held five (5)nine (9) meetings in 2017.

2022.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee (the “Nominating Committee”) is responsible for making recommendations to our boardBoard of directorsDirectors regarding candidates for directorships and the size and composition of our boardBoard of directors.Directors. In addition, the Nominating Committee is responsible for overseeing our corporate governance guidelines and reporting and making recommendations to our boardBoard of directorsDirectors concerning governance matters. Among other things, the Nominating Committee:

develops and recommends to the Board of Directors criteria for the selection of candidates for election as directors;

is responsible for a succession plan for, and when required, the search and recruiting of a Chief Executive Officer;

recommends to the Board of Directors a slate of persons to be directors consistent withconsidered as nominees of the criteria approved byBoard of Directors for election to the boardBoard of Directors and for whom the Board of Directors will solicit proxies;

periodically reviews and makes recommendations to the Board of Directors on the Board of Director policies and practices relating to corporate governance, independence of directors, and recommending director nominees to the full boardstock ownership of directors, attendance, conflicts of interest, ethics, and considers candidate recommendations of shareholders;

business conduct; andDirectors.

When evaluating nominees for director, the Nominating Committee considers the skills a nominee could offer the Company, as well as business experience, how the nominee fits into the Company’s core values, professional and personal integrity, policy-making experience and strategic planning skills, amongstamong other traits. Pursuant to the Company’s Corporate Governance Guidelines, the Nominating Committee will give appropriate consideration of

9

candidates recommended by shareholders and the procedure for shareholder nominations is set forth in the Company’s Bylaws and described under “Shareholder Proposals for the 2024 Annual Meeting—Deadline for Shareholder Proposals and Director Nominations to be Brought Before the 2024 Annual Meeting.”

The BoardNominating Committee has adopted a written charter forthat, among other things, specifies the Nominating Committee, a copyscope of whichits rights and responsibilities. The charter is available on the Company’s website at www.investors.sterlingbank.com. In 2017 and early 2018, the full Board discussed the merits of and appointed each of Lyle Wolberg and Rachel Tronstein Stewart to our Board and the board of directorsinvestors.sterlingbank.com/corporate-governance/governance-overview. The Nominating Committee held four (4) meetings in 2022. We have determined that all members of our banking subsidiary.Nominating Committee are considered “independent” under applicable SEC and Nasdaq listing rules.

Executive Compensation Committee

reviews and approves (or, if deemed appropriate, makes recommendations to the Board of Directors regarding) corporate performance goals and objectives which are relevant to executive officer compensation;

evaluates and approves (or, if deemed appropriate, makes recommendations to the Board of Directors regarding) the Company’s compensation plans, programs and policies, as well as the modification or termination of existing plans and programs;

reviews the Company’s compensation policies and practices for all employees regarding whether any risks arising from the Company’s compensation practices, policies and programs are reasonably likely to have a material adverse effect on the Company; and

reviews and oversees, in conjunction with the Nominating Committee, succession planning for the Chief Executive Officer and other executive officers in accordance with those objectives;

Company.

The Compensation Committee has adopted a written charter that, among other things, specifies the scope of its rights and responsibilities. The charter is available on the Company’s website at www.investors.sterlingbank.com.investors.sterlingbank.com/corporate-governance/governance-overview. The Compensation Committee held four (4) meetings in 2022. We have determined that all members of our Compensation Committee are considered “independent” under applicable SEC and Nasdaq listing rules. For additional information of the role of the Compensation Committee and its decisions with respect to 2022 executive compensation, see “Compensation Discussion and Analysis.”

Risk Committee

The Risk Committee is responsible for assisting the Board of Directors in fulfilling its oversight responsibilities with regards to the overall risk management programs of the Company. Among other things, the Risk Committee assists the Board of Directors with regards to the Company’s risk management programs as follows:

evaluates the Company’s strategic plan as to the nature and magnitude of potential risk exposures;

provides an open and ongoing communication forum between management, third parties, and the Board of Directors to discuss risks and risk management;

oversees the risk management practices of the Company in relation to the identification, measurement, monitoring, controlling, and reporting of the Company’s principal business risks as defined within the Company’s enterprise risk management framework;

serves as the primary oversight committee for specified risk areas, to include strategic, operational, and regulatory risks; and

provides secondary oversight for risk areas allocated to other Board of Directors committees such as credit, financial, and reputational risks, including intersections with the Company’s strategic plan and objectives.

The Risk Committee has adopted a written charter that, among other things, specifies the scope of its rights and responsibilities. The charter is available on the Company’s website at investors.sterlingbank.com/corporate-governance/governance-overview. The Risk Committee held four (4) meetings in 2022.

10

Ethics and Compliance Committee

The Ethics and Compliance Committee is a standing committee responsible for assisting the Board of Directors in fulfilling its oversight responsibilities regarding the ethics and compliance program of the Company. The Ethics and Compliance Committee assists as follows:

promotes ethical and compliance accountability throughout each level of the Company;

provides an open and ongoing communication forum between management, third parties, and the Board of Directors to discuss potential ethical issues and/or emerging trends in ethics; and

oversees the implementation and ongoing effectiveness of an ethics and compliance culture through all levels of the Company’s operations in conjunction with the various other Board committees and management.

The Ethics and Compliance Committee has adopted a written charter that, among other things, specifies the scope of its rights and responsibilities. The charter is available on the Company’s website at investors.sterlingbank.com/corporate-governance/governance-overview. The Ethics and Compliance Committee held two (2) meetings in 2017.2022.

11

Board of Directors Leadership Structure

Prior to the independent directors’ approval of the Corporate Governance Guidelines in April 2022, the Board of Directors did not have a policy regarding the separation of the roles of Chief Executive Officer and Chairperson of the Board of Directors, as the Board believed it was in the best interests of the Company to make that determination based on the then-current position and direction of the Company and membership of the Board of Directors. The Board believed that having the Chief Executive Officer also fulfill the role of Chairperson of the Board was the most effective and efficient structure given the extraordinary legal and regulatory challenges facing the Company. As the Board has added five (5) new independent directors over the past several years and continues to make substantial progress in managing its legal and regulatory challenges, the Board believes it is in the best interests of the Company to designate a lead independent director when the Chairperson is not an independent director. Under the Company’s Corporate Governance Guidelines, if the Chairperson of the Board is not an independent director, the independent directors will annually select one (1) independent director to serve as the lead independent director (the “Lead Independent Director”), who will act as the liaison between the independent directors and management and between the independent directors and outside advisors, including legal counsel. The independent members of the Board of Directors have selected Tracey Dedrick to serve as the Lead Independent Director. The Lead Independent Director has the following roles:

presiding at all meetings of the Board where the chairperson is not present and calling meetings of the independent directors, including executive sessions of the independent directors;

providing Board leadership where the Company’s CEO is also the chairperson and such role is or is perceived to be in a conflict of interest with the Company;

reviewing and approving Board meeting agendas and schedules for each Board meeting;

advising the CEO of the information needs of the Board and approving information sent to the Board;

chairing the quarterly executive sessions of the independent directors;

meeting with the CEO and chairperson to discuss any matters arising from the executive session and reporting the independent directors’ actions and recommendations to the Board; and

serving as interim chairperson if the chairperson is unable to continue to serve in such role.

Corporate Governance Enhancements

In January, 2022, the Company entered into an agreement in the form of a definitive stipulation of settlement (the “Settlement”), of which the court granted final approval on September, 2022, to settle the demand for a derivative action brought by a purported shareholder of the Company. The Company made a number of substantial corporate governance enhancements (the “Corporate Governance Enhancements”) during the course of 2021 and 2022, some of which were pursuant to the Settlement and many of which were either completed prior to receipt of the shareholder demand or during the time the Settlement was negotiated. Many of the Corporate Governance Enhancements, regardless of when implemented, were incorporated into the enhancements required pursuant to the Settlement, which has been posted to our website at investors.sterlingbank.com/corporate-governance/governance-overview. The Corporate Governance Enhancements include, among other things:

eliminating the staggered terms of office of the Board of Directors, as provided in the Articles Amendment;

establishing a new Risk Committee and Ethics and Compliance Committee;

updating the Board of Directors’ committee charters;

establishing the position of Lead Independent Director;

formalizing the roles of Chief Risk Officer and Chief Compliance Officer;

adopting Corporate Governance Guidelines; and

updating various Company policies and procedures, including our Code of Business Conduct and Ethics, and Whistleblower Policy.

12

As required under the Corporate Governance Enhancements, our Board of Directors also created a management-level Disclosure Committee. The Disclosure Committee assists the Company’s Chief Executive Officer and Chief Financial Officer in fulfilling their responsibility to oversee the accuracy, completeness, and timeliness of the public disclosure made by the Company.

The Company has enhanced its training and compliance program, which is being implemented and supervised by the Company’s Chief Risk Officer and Chief Compliance Officer. Training is mandatory for all directors, officers and employees, and includes function-specific coverage of applicable banking laws and regulations, standard operating procedures, and compliance, as well as standards of business conduct, whistleblower policy, insider trading policies, and manuals or policies concerning legal or ethical standards of conduct to be observed in connection with work performed for the Company.

Corporate Compliance Program

On March 15, 2023, the Company entered into a Plea Agreement with the DOJ, resolving the DOJ’s investigation. Under the Plea Agreement, the Company has agreed to, among other things, provide periodic reports to the DOJ with respect to compliance matters. For the period ending three years from the date of the Plea Agreement, the Company is required to review, test, and update its compliance program and internal controls, policies, and procedures described in the Plea Agreement and report back to the DOJ periodically. A number of the updates to the Company’s corporate compliance program correspond to and have already been implemented through the implementation of the Corporate Governance Enhancements noted above. The corporate compliance program includes, among other things:

ensuring that the Company’s directors and senior management provide strong, explicit, and visible support and commitment to the Company’s corporate policy against violations of the Securities Laws, its compliance policies, and its Code of Conduct;

developing and promulgating a clearly articulated and visible corporate policy against violations of the Securities Laws, memorialized in a written compliance policy or policies;

ensuring that the Company has a system of financial and accounting procedures, including a system of internal controls, reasonably designed to ensure the maintenance of fair and accurate books, records, and accounts;

reviewing the Company’s compliance policies and procedures regarding the Securities Laws no less than annually and updating them as appropriate to ensure their continued effectiveness, taking into account relevant developments in the field and evolving industry standards;

implementing mechanisms designed to ensure that the Company’s Code of Conduct and compliance policies and procedures regarding the Securities Laws are effectively communicated to all directors, officers, employees, and, where necessary and appropriate, agents and business partners;

instituting appropriate disciplinary procedures to address, among other things, violations of the Securities Laws and the Company’s Code of Conduct and compliance policies and procedures regarding the Securities Laws by the Company’s directors, officers, and employees;

developing and implementing policies and procedures for mergers and acquisitions requiring that the Company conduct appropriate risk-based due diligence on potential new business entities, including appropriate due diligence regarding the Securities Laws by legal, accounting, and compliance personnel; and

conducting periodic reviews and testing of its Code of Conduct and compliance policies and procedures regarding the Securities Laws designed to evaluate and improve their effectiveness in preventing and detecting violations of the Securities Laws and the Company’s Code of Conduct and compliance policies and procedures regarding the Securities Laws, taking into account relevant developments in the field and evolving industry standards.

Family Relationships

There are no family relationships among our directors or executive officers.

13

Communication with Directors; Attendance at Annual Meetings; Code of Ethics

Meetings

The Board of Directors invites shareholders to send written communications to the Board of Directors or any director by mail, c/o Chief Legal Officer and Corporate Secretary, Sterling Bancorp, Inc., One Towne Square, Suite 1900, Southfield, Michigan 48076. All communications will be compiled by the Company’s SecretaryChief Legal Officer and submitted to the Board of Directors or the individual director(s) on a regular basis unless such communications are considered, in the reasonable judgment of the Secretary,Chief Legal Officer, to be improper for submission to the intended recipient(s). Examples of shareholder communications that would be considered improper for submission include, without limitation, customer complaints, solicitations, communications that do not relate directly or indirectly to the Company’s business or communications that relate to improper or irrelevant topics.

All directors are expected to attend annual meetings of shareholders in person or via teleconference, except in cases of extraordinary circumstances. The Company anticipates that all directors will attend this year’sthe Annual Meeting.

Code of Business Conduct and Ethics

Our boardBoard of directorsDirectors adopted a codeCode of business conductBusiness Conduct and ethics (our “CodeEthics (the “Code of Conduct”) that, which applies to all of our directors, officers and employees, including our principal executive officer, principal financial officer, principal accounting officeremployees. The Ethics and persons performing similar functions.Compliance Committee, with the assistance of the Nominating Committee, is responsible for monitoring compliance with the Code of Conduct, and reports to the Board. The Code of Conduct is available on the Company’s website at www.investors.sterlingbank.com.investors.sterlingbank.com/corporate-governance/governance-overview.

Clawback Policy

The Company adopted policies (together, the “Clawback Policy”), which generally provide that the Board does not have a policy regardingof Directors may require current and former officers subject to the separationreporting requirements of Section 16 of the rolesExchange Act and other employees eligible to receive incentive compensation (the “Covered Persons”) to reimburse or forfeit excess incentive compensation, including equity awards, received by the Covered Person during the three (3) fiscal years preceding the restatement of Chief Executive Officerthe Company’s financial statements in the event that the Company issues such a restatement due to material noncompliance with securities laws, regardless of whether such Covered Person engaged in misconduct or was responsible for or contributed to the circumstances requiring the restatement. In addition, if the Board of Directors determines a Covered Person engaged in acts or omissions which involved intentional misconduct, intentional violations of the Company’s written policies or applicable legal or regulatory requirements or fraud, and Chairmanwhich contributed to the circumstances requiring the restatement, the Board of Directors may require the Covered Person to forfeit all of the Covered Person’s incentive compensation received during the three (3) fiscal years preceding the restatement and to reimburse the Company for costs incurred in connection with the restatement. The Clawback Policy also provides that in the event a Covered Person engages in certain detrimental conduct that, in the discretion of the Board of Directors, is likely to cause or has caused material financial, operational or reputational harm to the Company, the Board of Directors may require reimbursement or forfeiture of all of the Covered Person’s incentive compensation received from and after the date on which such conduct occurred. The Board of Directors has discretion to determine the method for recouping any incentive compensation under the Clawback Policy.

Whistleblower Policy

Our Board of Directors adopted a revised Whistleblower Policy in 2021 that is intended to enable employees, customers, vendors, independent contractors, agents, or any other interested party to promptly report good faith complaints or concerns regarding potential or actual violations of applicable laws, regulations or the Company’s policies, including violations of our Code of Conduct. Our senior management, Board of Directors and employees have participated in whistleblower training presentations in connection with our Corporate Governance Enhancements and revised Whistleblower Policy. Our Audit Committee and Ethics and Compliance Committee has oversight over the receipt, retention and treatment of concerns or complaints received by the Company regarding accounting, internal accounting controls, auditing matters, or unethical or illegal behavior. A committee comprised of the Company’s General Counsel, the Chief Risk Officer and the Chief Compliance Officer is responsible for ensuring all whistleblower complaints are appropriately handled. In connection with the Corporate Governance Enhancements, the Board made certain revisions to the Whistleblower Policy, including by adding additional reporting mechanisms and further elaborating on the Company’s prohibition against retaliation against whistleblowers. The Whistleblower Policy is available on the Company’s website at investors.sterlingbank.com/corporate-governance/governance-overview.

14

Insider Trading Policy and Anti-Hedging Policy

We have adopted an Insider Trading Policy that sets forth restrictions on trading in our securities and on providing any material nonpublic information relating to the Company. This policy is applicable to our directors, officers and employees, as well as any other person having access to material nonpublic information of the Company. This policy also applies to the foregoing persons’ family members or others who reside with them, and any other persons or entities whose securities transactions are directed by the foregoing persons or subject to their influence or control. This policy was adopted to promote compliance with federal securities laws and applicable Nasdaq requirements. Our Insider Trading Policy allows for purchases or sales of Company securities made in compliance with a written plan that meets the requirements of Rule 10b5-1 of the Exchange Act, and sets forth the applicable trading window periods where directors and designated employees are able to trade in the Company’s securities. Our Insider Trading Policy prohibits all of our directors, officers and employees, as well as any other person having access to material nonpublic information, from entering into certain forms of hedging or monetization transactions that allow such person to lock in much of the value of his or her stock holdings in exchange for all or part of the potential upside appreciation of the Company’s stock, such as zero-cost collars and forward sale contracts. Such transactions allow such person to continue to own the Company’s stock without the full risks and rewards of ownership, which may cause such person to no longer have the same objectives as the Board believes itCompany or other shareholders. Similarly, our Insider Trading Policy prohibits short sales, standing orders and transactions in publicly traded options. Additionally, a director, officer or employee desiring to hold Company securities in a margin account or pledge Company securities as collateral for a loan must notify the Company’s Chief Legal Officer prior to taking such action because a margin sale or foreclosure sale may occur at a time when such person, a pledgor, is aware of nonpublic information or otherwise not permitted to trade in the best interestsCompany’s stock. Finally, our Insider Trading Policy prohibits the use of derivative securities to separate any financial interest in our Company’s securities from related voting rights and any transaction in the Company to makeCompany’s securities where a reasonable investor would conclude that determination based on the then-current position and directionsuch transaction is for short-term gain or speculative.

Board of the Company and membership of the Board. The Board believes having the Chief Executive Officer also fill the role of Chairman is more efficient and effective at this time than alternate structures.

Our boardBoard of directors sets the tone at the top of our organization, adoptingDirectors adopts and overseeingoversees the implementation of our company-wide risk management framework, which establishes our overall risk appetite and risk management strategy. Risk management refers generally to the activities by which we identify, measure, monitor, evaluate and manage the risks we face in the course of our banking activities. These includeOur enterprise risk management framework seeks to achieve an appropriate balance between risk and return, which is critical to optimizing shareholder value. We have established processes and procedures intended to identify, measure, monitor, report and analyze the types of risk to which we are subject, including compliance, regulatory, liquidity, interest rate, credit, operational, cyber/technological, legal, compliance, regulatory, strategic, financial and reputational risk exposures. However, as with any risk management framework, there are inherent limitations to our risk management strategies as there may exist, or develop in the future, risks that we may not have appropriately anticipated or identified.

Compliance. Our boardBoard of directorsDirectors and management team have createdare striving to create a risk-conscious culture that is focused on quality growth, which includes infrastructure capableaddressing compliance issues. In 2021, the Board of addressingDirectors created a new Risk Committee. See “Proposal No. 1: Election of Directors—Risk Committee” above, for more information on the evolvingrole and responsibility of the Risk Committee. We hired a Chief Risk Officer in February 2020 to create, implement, improve and administer the risk management programs for the Company. The Chief Risk Officer is responsible for the Company’s risk governance, further developing and maintaining a risk aware culture and implementing risk decision-making into day-to-day operations. The Chief Risk Officer reports directly to the Risk Committee and to the Company’s Chief Executive Officer. In 2021, the Board of Directors also created a new Ethics and Compliance Committee. See “Proposal No. 1: Election of Directors—Ethics and Compliance Committee” above, for more information on the role and responsibility of the Ethics and Compliance Committee. Through the creation of the Risk Committee and Ethics and Compliance Committee, we are focused on, and continually invest in, our risk management and control environment. Our business teams, supported by our risk, compliance, legal, finance and internal audit functions, work together to identify and manage risks we face,applicable to our business, as well as to enhance our control environment.

Culture. Our Board of Directors and its committees play a key role in oversight of our culture, setting the changing regulatory“tone at the top” and compliance landscape. Our riskholding management approach employs comprehensiveaccountable for its maintenance of high ethical standards and effective policies and processespractices. The Company’s core values include community, service, integrity and employees working together. We embrace diversity and inclusion, which we believe fosters creativity, innovation and thought leadership through new ideas and perspectives.

15

Governance and Social Highlights

We are committed to establish robuststrong corporate governance and emphasizes personal ownership and accountability for risk with our employees.social responsibility. We also perform an annual capital stress test through which we considerbelieve this commitment is essential to the worst case scenario published by the Federal Reserve Board and evaluate the effect on the capital positionlong term success of the Company. We seekThe bullet points below highlight the ways we invest in corporate governance and social responsibility. All data and statistics are as of December 31, 2022.

Diversity and Inclusion

2 out of 9 directors are female

1 director is a person of color

1 director is Asian

1 director is a US Army veteran

56% of SVPs and above are female

56% of employees are female

64% of employees identified within an ethnically diverse group

49% of assistant vice presidents or higher level position are female

56% of assistant vice presidents or higher level position identified within an ethnically diverse group

Board Governance

Lead Independent Director

89% of the Board is independent

Committees comprised of independent directors

Non-classified Board (annual election of directors)

Community Impact

Invested $1 Million in a Community Development Financial Institution (“CDFI”) to buildincrease the supply of affordable housing rentals for individuals and families earning 60% or less of the area median income which allows low income individuals to live, work and raise their families in communities throughout California, creating a risk management culture through educationalmore economically diverse and stable economy.

Invested in four Minority Depository Institutions (“MDI”) totaling $929,000. MDIs serve a vital role of promoting the economic viability of minority and under-served communities.

Approximately 50 employees volunteered close to 600 hours conducting financial literacy seminars, fortechnical assistance to small businesses, first time homebuyer classes, elder abuse seminars and distribution and packing of foods.

Eight of our employees management analysisserve as directors on the board of risk scenarios, risk performance studiesnonprofits and the formulationCDFIs. Most of contingency plans.these nonprofits and CDFIs support, affordable housing, permanent housing, access to capital for minority owned business, technical assistance for small businesses, workforce and economic development services to diverse communities and affordable healthcare to low-income individuals and families.

Business Conduct

Code of Business Conduct and Ethics

Whistleblower hotline for anonymous reporting of violations

Corporate Governance Guidelines

Work Environment

We are committed to providing a workplace that is free of harassment and discrimination by taking proactive measures and providing all employees with non-discrimination and sexual harassment prevention training on an annual basis.

We continue to support and provide diversity training to all employees to increase cultural competency and collaboration.

We continue to offer over 600 technical and professional development courses and educational reimbursement for approved external training opportunities.

The executive officers of the Company serve at the pleasure of the Board. SetBoard of Directors. In addition to Mr. O’Brien, set forth below are the current executive officers of the Company and a brief explanation of their principal employment during at least the last five (5) years. Additional information concerning the employment arrangements of the Company’s executive officers is included elsewhere in this proxy statement under the heading “Compensation of

Karen Knott, Executive Officers and Directors – Executive Compensation.”

Elizabeth M. Keogh, Chief Legal Officer and Divisional Controller. Prior to Sterling, he served as a senior financial analyst at First of America Bank Corporation, credit card product manager at NBD Bank, N.A., and credit card portfolio analyst for Security Bancorp, Inc., later acquired by First of America Bank Corporation. Mr. Lopp has a B.B.A. in Finance from Walsh College.

Colleen Kimmel, Executive Vice President and General Counsel, age 42. Ms. Kimmel has served as the Bank’s General Counsel since 2016. Ms. Kimmel joined the Bank as corporate counsel in 2012. Ms. Kimmel previously served as the Company’s General Counsel from 2016 to October 2022 and as the Company’s Corporate Secretary from 2016 until March 2023. Prior to joining the Bank, Ms. Kimmel worked as corporate counsel at First Place Bank from May 2011 to December 2012 and as in-house counsel in the real estate division at Sprint Nextel from August 2010 to 2011. Ms. Kimmel received her bachelor’s degree from Michigan State University and juris doctor from Michigan State University College of CommercialLaw.

Christine Meredith, Executive Vice President and Retail BankingChief Risk Officer, age 49. Ms. Meredith has served as the Bank’s Chief Risk Officer since 2016,2020. Prior to joining the Bank, Ms. Meredith served in various risk management and regulatory compliance roles, including SVP & Director, Enterprise Risk Management with Columbia Bank from December 2010 to January 2020. Before joining Columbia Bank, Ms. Meredith held various roles working with the Federal Deposit Insurance Corporation from 2009 to 2010, Washington Mutual from 2003 to 2009, and Union Bank of California in 2003. Ms. Meredith received her bachelor’s degree from Georgetown University.

17

This Compensation Discussion & Analysis (“CD&A”) sets forth the Company’s executive compensation philosophy, practices and decisions for the fiscal year 2022 for its named executive officers (“NEOs”) listed below and included in the Summary Compensation Table.

Name | | | Title Held with the Company During 2022 |

Thomas M. O’Brien | | | Chairman, President and Chief Executive Officer |

Karen Knott | | | Executive Vice President, Chief Financial Officer and Treasurer |

Elizabeth M. Keogh1 | | | Chief Legal Officer |

Colleen Kimmel | | | Executive Vice President, General Counsel and Corporate Secretary |

Christine Meredith | | | Executive Vice President and Chief Risk Officer |